2025 Business Mileage Rate - 2025 Business Mileage Rate. Mileage pad is a web application that helps you track mileage driven for reimbursement and tax purposes. While the 2025 irs standard business mileage rate hasn’t yet been announced, it’s certainly worth discussing what the rate might be, how it might affect you or your business, and where. 2025 California Mileage Reimbursement Rate Isaac Gray, Find standard mileage rates to calculate the deduction for using your car for business, charitable,.

2025 Business Mileage Rate. Mileage pad is a web application that helps you track mileage driven for reimbursement and tax purposes. While the 2025 irs standard business mileage rate hasn’t yet been announced, it’s certainly worth discussing what the rate might be, how it might affect you or your business, and where.

Business Mileage Reimbursement 2025 Chlo Meghan, 21 cents per mile (1 cent.

Standard Mileage Rate 2025 Enrica Anastasie, While the 2025 irs standard business mileage rate hasn’t yet been announced, it’s certainly worth discussing what the rate might be, how it might affect you or your business, and where.

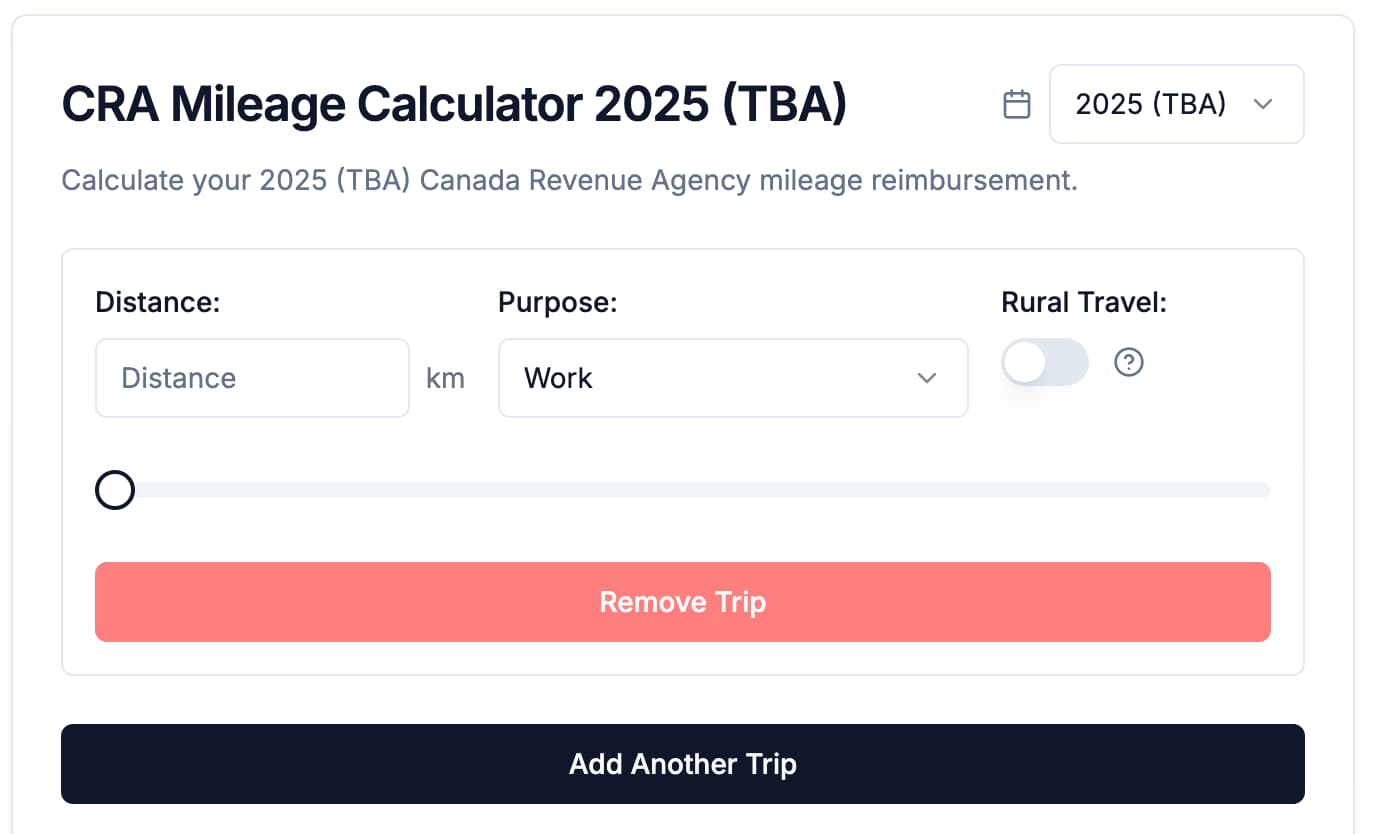

CRA Business Mileage Rate 2025, The 2025 standard mileage rate is 67 cents per mile, a full 11 cents higher than the 56 cents per mile it.

Mileage Rate For 2025 Renae Salome, As we approach 2025, small business owners need to prepare for changes in tax laws that could impact their mileage deductions.

Gov Mileage Rate 2025 Elka Martguerita, As we approach 2025, small business owners need to prepare for changes in tax laws that could impact their mileage deductions.

Mileage For Business 2025 Janie Philis, For 2025, the irs mileage reimbursement rate is 67 cents per mile for business travel.

The mileage reimbursement rate slightly changes from year to year. This is an increase of 1 and a half cents from 2023 (up from 65.6 cents).

Business Mileage Reimbursement 2025 Chlo Meghan, Other options include a fixed.

Irs Business Mileage Rate 2025 Rules Sam Russell, With the 2025 mileage rate announcement coming later this year, you need a plan to maximize every deductible mile.